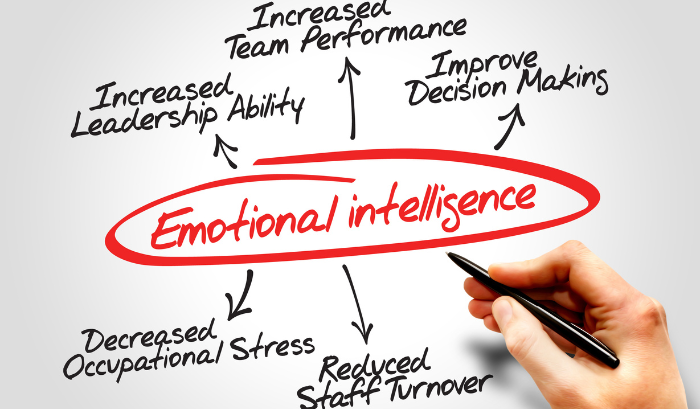

The Power of Emotional Intelligence in Leadership

Emotional intelligence (EI) is a set of skills that can help you perceive, use, and manage emotions. It’s a critical part of leadership and is key to success in the workplace. In the workplace, EI is essential for success in many roles, from customer service to management. It involves skills such as active listening, empathy, and self-awareness, which enable individuals to build strong relationships with colleagues, clients, and customers.

Emotional intelligence is defined as “the ability to monitor feelings and emotions, to discriminate among them, and to use this information efficiently in thinking, feeling and acting” (pressbooks.usnh.edu/ld820/chapter/3). This definition is made up of three components: self-awareness; self-management; social awareness/relationship management (otherwise known as empathy). Self-awareness is recognizing and understanding personal emotions and how they impact behavior, while self-management is the ability to regulate and control personal emotions and responses to situations. Empathy involves understanding the emotions of others and using that understanding to communicate effectively, build relationships, and resolve conflicts (psychologytoday.com/us/basics/empathy).

By developing these skills, individuals can improve their communication and interpersonal relationships, leading to greater success in both personal and professional settings.

Emotions Aren’t a Liability

As powerful as EI may be, many leaders aren’t making much use of it. Why? Perhaps it’s because they don’t know how. Or perhaps “experts” have told them that they are a liability in the workplace—that if they want to climb the corporate ladder, they should keep their feelings under wraps and their heads down at all times.

But what do you do when your boss yells at you, or your colleagues are angry at you? How can you lead effectively when others feel stressed out or depressed? EI is about more than just being nice. It’s about recognizing and managing your emotions, so you can better understand other people’s feelings—and respond appropriately in difficult situations like these.

Daniel Goleman, author of the bestselling “Emotional Intelligence” argues that humans have entered an era in which thinking for themselves is no longer enough. You need to think empathically.

Empathy Builds Connections

Goleman defines empathy as “the ability to understand and share the feelings of another” (resilienteducator.com/classroom-resources/daniel-golemans-emotional-intelligence-theory-explained). Empathy allows you to see things from another person’s perspective, which can help you better connect with them and understand their perspective. And it turns out that empathy is a skill that can be developed.

You may have heard that leaders should lead by example, but that’s not enough anymore. Today’s workforce wants leaders who listen and show concern for their employees’ well-being—in other words, they want leaders with high levels of EI. According to Forbes.com, empathetic leadership helps companies retain productive and innovative employees, which can further contribute to a company’s profitability. Empathetic leaders can understand and relate to the emotions and experiences of their employees, which can help employees feel more comfortable and motivated at work.

This type of leadership is particularly important during times of crisis, such as during the COVID-19 pandemic, when employees felt anxious and uncertain. Empathetic leaders can help alleviate these feelings by showing compassion and understanding towards employees, which in turn can lead to increased loyalty and commitment to the company. In short, empathetic leadership is not only a way to create a positive work environment but also a smart business strategy.

Empathetic Leadership Builds Trust

If you want people to trust you and follow you willingly from one challenge to the next, then leading with your heart may be your best bet. You can’t lead without trust. It’s the foundation of any relationship, and it’s especially critical in your leadership role. Trust is a two-way street: If you want people to trust you, you must earn their trust.

But trust doesn’t come easy—it takes time and effort to build it up, and once broken, it can be difficult or impossible to repair. Trust is based on shared values and mutual respect. If coworkers or employees don’t feel you respect them, then building trust won’t happen naturally.

Conclusion

The best leaders are those who can balance head and heart. They can think logically about their options and make sound decisions, but they also have an emotional intelligence that allows them to connect meaningfully with others.

This doesn’t mean leaders have to make every decision with an eye toward how it will affect people’s feelings. Sometimes, it’s better for everyone involved if you keep things professional and detached from personal issues. But when there are opportunities for genuine connection—when doing so would make all the difference in getting someone on board with your ideas or goals—then by all means, lead from your heart.