ABN Newsletter Volume 2, Issue 1 October 2018

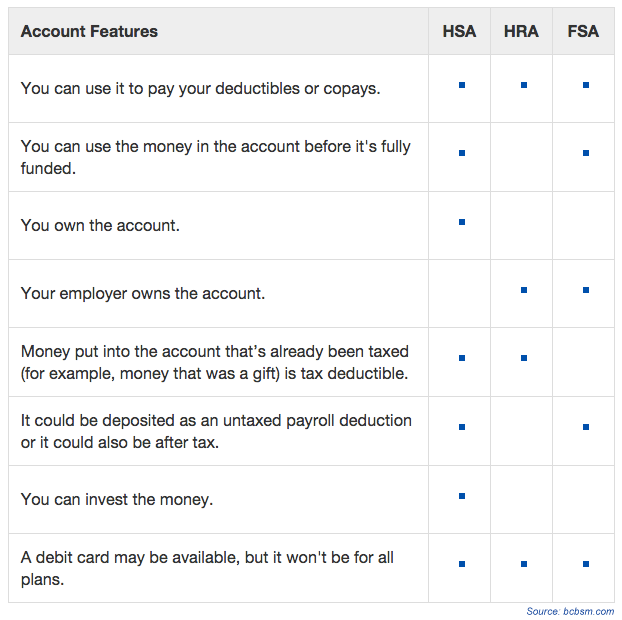

Health spending accounts are used to pay for medical expenses that your healthcare plan doesn’t cover, such as deductibles or copays. They’re part of what’s called consumer-directed health care. Consumer-directed means you manage more of the money you spend on health care costs.

There are several types of health spending accounts, including:

Money is deposited in these accounts tax-free and is taken out tax-free or tax-deductible. You can use it to pay for qualified medical expenses. A debit card may also be available depending on your plan. Where they differ is the kind of health plan they work with, who owns the account, who controls it and who can put money into it. Here is a comparison chart showing some of the similarities and differences:

If you have one of these health savings accounts, it’s important to be aware of what is considered a qualified medical expense to be able to use these funds. A qualified medical expense is one that can be purchased with tax-free money through your health savings account.

Some examples of qualified expenses include:

Note that some qualified medical expenses require a prescription from your doctor. If you’re thinking about purchasing something with your health savings account, it’s recommended that you first check to ensure that the expense is qualified and what the procedure is for getting it covered (such as sending a copy of your prescription or receipt or filing a reimbursement request form).

Life happens, and when it does, it is very likely that your health insurance coverage may need to change. When you encounter a qualifying life event that impacts your insurance needs, it is important to know that you can take advantage of a special enrollment period – since most people are unaware that they may enroll outside of open enrollment.

This guide is created to help you understand everything you need to know about qualifying life events and the special enrollment period. You will learn whether or not you qualify and what documents you will need prior to enrolling and shopping for coverage.

Due To:

Due To:

Due To:

Permanently move to another state and/or no longer live in the existing/prior plan’s service area.

REQUIRED PROOF: New Mortgage Bill/Renter’s Agreement and drivers license, utility, Postal Service change of address receipt.

Your primary policyholder passed away leaving you with no coverage.

REQUIRED PROOF: Death Certificate, Copy of termination letter from prior insurance company.

That makes you newly eligible or ineligible for a tax credit.

REQUIRED PROOF: Copy of certificate of creditable coverage OR a copy of the termination letter from prior Insurance Company and/or federal or state agency.

Your current plan ends on a non-calendar year basis.

REQUIRED PROOF: Copy of termination letter from prior insurance company OR Certificate of Credible Coverage Anytime that you enroll in a plan you will be asked to provide the following information:

So how long is this special enrollment period? Typically, you only have 60 days from the QLE to enroll in a new plan due to ACA law, carriers are very strict on enrollment timelines.

Navigating the tricky waters of health insurance terminology can be difficult. This is why we’ve put together this handy guide featuring some of the most popular insurance language terms and explaining just what they mean as it relates to you and your family.

Coinsurance is your share of the costs of a covered healthcare service calculated as a percent (for example, 20 percent) of the allowed amount for the service. You pay coinsurance plus any deductibles you still owe for a covered health service.

A premium is the amount of money charged by an insurance company for coverage. The cost of premiums may be determined by several factors, including age, geographic area, tobacco use, and number of dependents.

A copayment, or co-pay, is a fixed amount you pay for a covered health care service, usually when you get the service. The amount can vary by the type of covered health care service.

A deductible is an amount you owe for health care services each year before the insurance company begins to pay. For example, if your annual deductible is $1,000, your plan won’t pay anything until you’ve met your $1,000 deductible for covered health care services that are subject to the deductible. The deductible may not apply to all services, such as when a co-pay only applies or preventive care services. Deductibles are useful for keeping the cost of insurance low. The amount varies by plan, with lower deductibles generally associated with higher premiums. They are fairly standard on most types of health coverage.

An out-of-pocket maximum is the most you should have to pay for your health care during a year, excluding the monthly premium. It protects you from very high medical expenses. After you reach the annual out-of-pocket maximum, your health insurance or plan begins to pay 100 percent of the allowed amount for covered health care services for the rest of the year. The deductible, coinsurance, co-pays and prescription drug co-pays are included in the out-of-pocket maximum.

In the past, health insurance carriers imposed Annual and Lifetime limits on the benefits you receive. You are no longer subject to these limitations and there is no maximum to the benefits you may receive.

Rather than waiting for a patient to become sick, preventive care aims to keep people healthy, or at least catch illnesses at their earliest and most treatable stages. Preventive care includes preventive services performed by providers, such as annual physicals or mammograms. Under the provisions of the Affordable Care Act (ACA), policies must cover various preventive services for men, women, and children without sharing the cost for these services through coinsurance, deductibles or copayments. Certain Preventive care services are subject to frequency limitations.

This plan allows you to receive care from any doctor you choose, no referral for specialty care (except United HealthCare FL), may use out-of-network doctors – but may have to pay additional fees. PPO plans typically have higher monthly premiums.

Very similar to a PPO. The biggest difference between the two is the contract between the insurance carrier and healthcare providers.

Must pre-select an approved Primary Care Physician, referrals are needed and for most plans, there are no out of network benefits except for qualifying emergencies. HMO plans typically have lower monthly premiums.

This is a hybrid network that has limitations that vary based on the carrier. In some instances, you would need to get referrals and may not have coverage for out-of-network. These plans typically have a lower monthly premium.

Workforce Health Promotion programs have evolved from fitness, to health promotion, to comprehensive wellness programs. In the past, the focus was on physical fitness. Today, the focus has broadened to include topics such as nutrition, mental health, and chronic disease prevention, as well as the workplace environment, policies, productivity, and others. Additionally, employers’ Workforce Health Promotion programs vary according to workforce size, program scope, resources, and leadership support.

Experts agree that planning and designing a Workforce Health Promotion program is essential to ensuring the program’s success. Just as one would not begin a long trip without considering how to reach one’s destination, planners should not begin a Workforce Health Promotion program without mapping out where the program needs to go, and how it will get there.

Before embarking on a Workforce Health Promotion program, consider some important attributes of a comprehensive program identified from these selected planning resources from the Centers for Disease Control (CDC):

Many business tools related to project management, process improvement, and problem-solving can also be applied to workforce health promotion design and implementation.

Effective October 2, 2018, a new rule will allow individuals to purchase short-term, limited-duration health insurance coverage for a period of less than 12 months, and renew such coverage for up to 36 months. Under current law, the maximum coverage period for short-term, limited-duration health insurance is less than 3 months, and these policies cannot be renewed.

Notably, short-term, limited-duration health insurance is:

Click here to read the new rule. A fact sheet is also available.

The HR Self-Assessment Guide is composed of six modules. Each HR assessment section may be taken independently of the others, and is separately graded. You may take each module as many times as you like. Once you complete a module, your score will be calculated and displayed along with explanations for the answers in that module. Your scores are not stored in a database, so please print the results page for each module if you need it for future reference. The six modules comprising the Guide are listed below:

Please follow the instructions below as you answer the questions:

Whether your company has 5 or 500 employees, it’s important to conduct a regular review of your HR and benefits-related notices, records and procedures to ensure compliance with the law and prevent potential liabilities and employee lawsuits. The checklist below features key steps for evaluating your management practices to help keep your company HR compliant.

Please note that the above list is not all-inclusive. If an HR assessment reveals violations that are not subsequently corrected, your company could be at risk for costly fines or lawsuits. If you have any questions regarding your obligations under the law or about best practices when it comes to HR compliance, please consult with a knowledgeable employment law attorney for individualized guidance.

Terminating an employee, whether for misconduct or a reduction in force, is never a pleasant task. However, at times it is a necessary part of managing a workforce. Voluntary termination by an employee through resignation or retirement may not carry the negative stigma of an involuntary termination, but it does trigger certain responsibilities for the employer.

Each step in the process of terminating an employee should be carefully executed. Each step must be carefully and thoroughly documented. If an employee is discharged for poor performance and later sues alleging discrimination, the employer will have a difficult time defending if the personnel file is devoid of any documentation of the poor performance over a reasonable period of time.

Note: Terminating an employee is a very sensitive matter, requiring careful communication and documentation to avoid potential lawsuits or other future problems. It is prudent to consult an employment law attorney or HR specialist before taking any specific steps should the need to terminate an employee arise.

Although “at-will” employment is common to virtually all states, employees do have substantial statutory protection, as well as remedies found in judicially recognized exceptions to the at-will employment rule.

Statutory Protections

Although this list is not exhaustive, you can see the need for sound HR practices regarding termination, because there are many potential pitfalls for employers surrounding terminations.

With hurricane season approaching, the IRS is offering advice to those impacted by storms and other natural disasters. The following tips may help businesses prepare for such events:

The IRS offers many resources to help employers plan for and recover from disasters, including IRS Publication 584-B, Business Casualty, Disaster, and Theft Loss Workbook, and webpages devoted to preparing for a disaster and tax relief in disaster situations.